As per income tax rules a person should have only one PAN number. If you have multiple PANs then you have to close the other PANs. If you are firm and not running your business anymore then also you need to close the PAN of that firm.

As per section 272B of the income tax act 1961, a penalty of 10,000 Rs can be levied if anyone has more than One PAN.

1. You can surrender your other PAN numbers either online or offline, but the offline process is more effective than the online process.

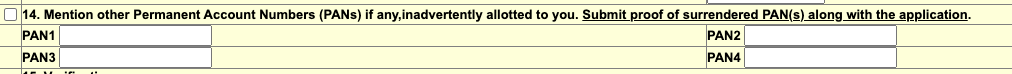

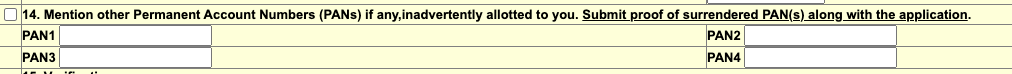

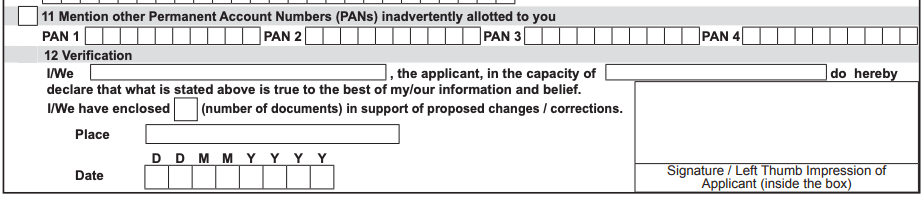

2. To surrender your other PANs which were not linked with any other services, you need to fill PAN correction form and in the field no .11 of this form you have to mention the other PAN numbers, which you want to surrender.

3. To surrender (or) cancel your currently using PAN / PAN of the firm you have to write a request letter to your local income tax assessing officer.

Here are some sample PAN card surrender letter formats for both individuals and firms, which you download in Word format.

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card surrender request.

My name is ___________(your full name) writing this request letter to surrender my PAN card bearing number BUORR45678X .

I have been issued with Two PANs, I got my old PAN bearing no. FAXX1245C long ago, but unfortunately, I thought I lost it, and I applied for a new PAN.

But recently I have found my old PAN card, so I would like to close my new PAN card and continue with the old PAN. I have deregistered my new PAN number with all the services.

So kindly cancel my PAN card bearing no. BUORR45678X . I shall be grateful to you in this regard.

Yours faithfully,

Your name.

(Mobile no.)

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card surrender request of _______(firm name).

We the ____________(your firm name) requesting you to cancel our PAN bearing number ________(firm PAN no.).

We have shut down our business due to financial problems / tough competition / personal reasons/partnership-related problems. The shutdown has been done as per all the legal proceedings.

Hence our firm is no longer operating now, we would like to cancel the PAN of the firm.

So kindly cancel the PAN of our firm bearing number _______(firm PAN no.) and also find the enclosed copy of the PAN card.

Yours sincerely,

Your name.

(Mobile no.)

It is better to cancel the PAN of the deceased person. It is important to transfer the properties of the deceased person to his/her legal heirs.

If the deceased person is an income taxpayer then the tax should be paid from the assets of the deceased person under section 159 of the income tax act 1961.

Letter Format

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card cancellation request for late Sri/Smt_______(Deceased person name)

I am ___________(your name) legal heir of late Sri./Smt. _____________ writing this request letter to cancel the PAN of my deceased father/mother/husband bearing PAN number ________.(PAN no. of the deceased person).

His / Her IT returns have been filed up to the latest financial year and please find the enclosed copies of ITR payment receipts, death certificate, and legal heir certificate attached with this letter.

So kindly cancel the PAN of late Sri/Smt_____________(deceased person name) bearing PAN number ________.

I shall be obliged to you in this regard.

Yours faithfully,

Your name.

(Mobile no.)

After submitting the above request letters to the income tax department, collect the acknowledgment receipt.

15 days, from the date of submitting the request letter to the income tax office.

How can I check my PAN card surrender status?Step 1: Go to verify your PAN on the income tax website.

Step 2: Enter your PAN number, name, date of birth, and mobile number.

Step 3: Now you will receive an OTP, and enter that OTP.

Step 4: Now the status of your PAN will be visible to you on the screen, it shows whether your PAN is active (or) inactive.

You can change your PAN number by filling out a form at your bank (or) you can also do this through your bank’s internet banking portal.

Can I surrender my PAN card line?Yes, you can surrender your PAN card online at https://tin.tin.nsdl.com/pan/changerequest.html website.

Also Read

I have surrender my Dual PAN card in IT department directly. How many days it will take to get inactive. Reply

I am having two PAN cards ADAPY6412H not linked wit addhar card & HBBPQ9844Q i want to surrender HBBPQ9844 Q which is linked with my addhar card Reply

The ITO asks for an Indemnity bond to surrender the duplicate PAN card, but specimen is not available. Can you help. thanks Reply

VIJAY PRATAP SINGHINDEMNITY BOND For PAN Card Surrender or Deactivation I,____________ S/o ______________. Residing Address Contact No +91—Mobile No. do hereby solemnly affirm and declare as under:

1) My PAN is: *************.

2) I am regularly assessed in your ward/jurisdiction with PAN: __________________.

3) I have only one PAN i.e. __________________ which is used for last many years for filing my income tax returns.

4) I do not have any other PAN (___________________) with me, if any allotted in your records, kindly deactivate the same.

5) I undertake to indemnify the income Tax Department for any loss that may be caused in the future.

6) Kindly activate my PAN: _________________. & kindly deactivate my PAN: ___________________. That the above statements are true and correct to the best of my knowledge and belief. *****************

(Deponent)

Place: Delhi.

Date: 18/11/2023. VERIFICATION

Verified at _____________________, Delhi, on this ________day of ___________, 20_____. That the contents of the above affidavit are true and correct to the best of my knowledge and belief. No part of it is false and nothing material has been concealed there from.

(Deponent)

Place: Delhi.

Date: 18/11/2023 Reply